Homeownership in France

Nearly six in ten households own their home in France. Homeownership rose considerably after World War II, then came to a standstill in the mid-1980s. Today, an increasing share of the population is finding it hard to buy a home.

In 2014, approximately 16.5 million households in France owned their home. 57.6% of the country’s 28.8 million main homes are owned by their inhabitants.

A home, but on credit

In seven in ten cases, households purchasing a home choose a house, either newbuilt or on the resale market.

Some pay cash, others inherit, but the vast majority (over 80%) have to take out a long-term housing loan, especially if they are buying for the first time. First-time buyers in France are termed “accédants” until they have finished paying off their loan. Given the country’s ageing population, the share of “non accédants” is rising: in 2014, seven in ten owners in France had completed payments on their first home. Owners who have paid off their loans now outnumber renters (40.7% as against 39.3%).

The rise in homeownership in France

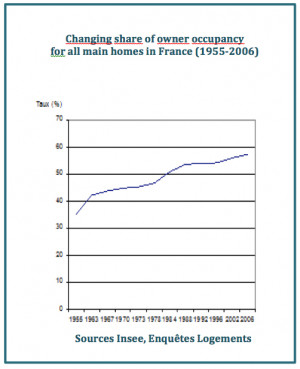

In 1955, slightly over one-third of households in France (35%) owned their main home. Their share soon rose thanks to state-subsidized building loans and loans for purchasing public housing units, as well as the development of private lending organizations. The 1977 reform further accelerated the process, as did building industrialization in France: property acquisition loans (PAP) and personalized housing loans (APL) enabled massive numbers of mid-level managers, technicians and skilled manual workers to become homeowners.

In the early 1980s, homeowners became the majority in France: more than half of households were now living in self-owned housing. However, the rate soon stagnated due to unemployment, anti-inflation policies and reduced state aid.

In the early 2000s, the proportion of first homebuyers and poorer household buyers fell. From 2000 to 2009, the share of homeowner households rose slightly from 55.6% to 57.6%. Wage stagnation and dramatically rising real estate prices in major cities have intensified inequalities in home acquisition

Everyone a homeowner?

People do not all become homeowners in the same way. These more or less marked disparities call into question public policy effectiveness. Poorer households in particular are highly dependent on state home-buying aid. In the years 2002-2006, very few first homebuyers in France (6.3%) figured in the 1st (poorest) quartile of households—a smaller share than in the late 1990s (8.7% from 1997-2001). Poorer owners are often families with children who buy homes in small cities and rural towns; they seldom purchase in Paris.

Young households must often wait before owning a home. In 2010, the average age of persons buying a home on credit was 37 years. The largest segment (40%) were in their thirties; 26% are under 30.

Lastly, fewer than half of immigrants’ descendants and only one-third of immigrants in France own their home. While these rates are rising, there are still considerable differences between immigrants from other EU countries and Southern Asia—whose rates are close to those for the majority population (excluding immigrants and immigrants’ children)—and immigrants from North Africa and—above all—sub-Saharan Africa, whose homeownership rates are much lower.

Contact: Anne Lambert

Online: January 2015